haven't filed taxes in years canada

Thats just for the first. For the sponsors employment section I wrote that I dont have a notice of assessment.

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

The clock is ticking on your chance to claim your refund.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/R2FBAA3WQVEAJHHRZEGBS623T4)

. If you fail to file your taxes youll be assessed a failure to file penalty. Section 239 of the Income Tax. Unfiled Taxes What If.

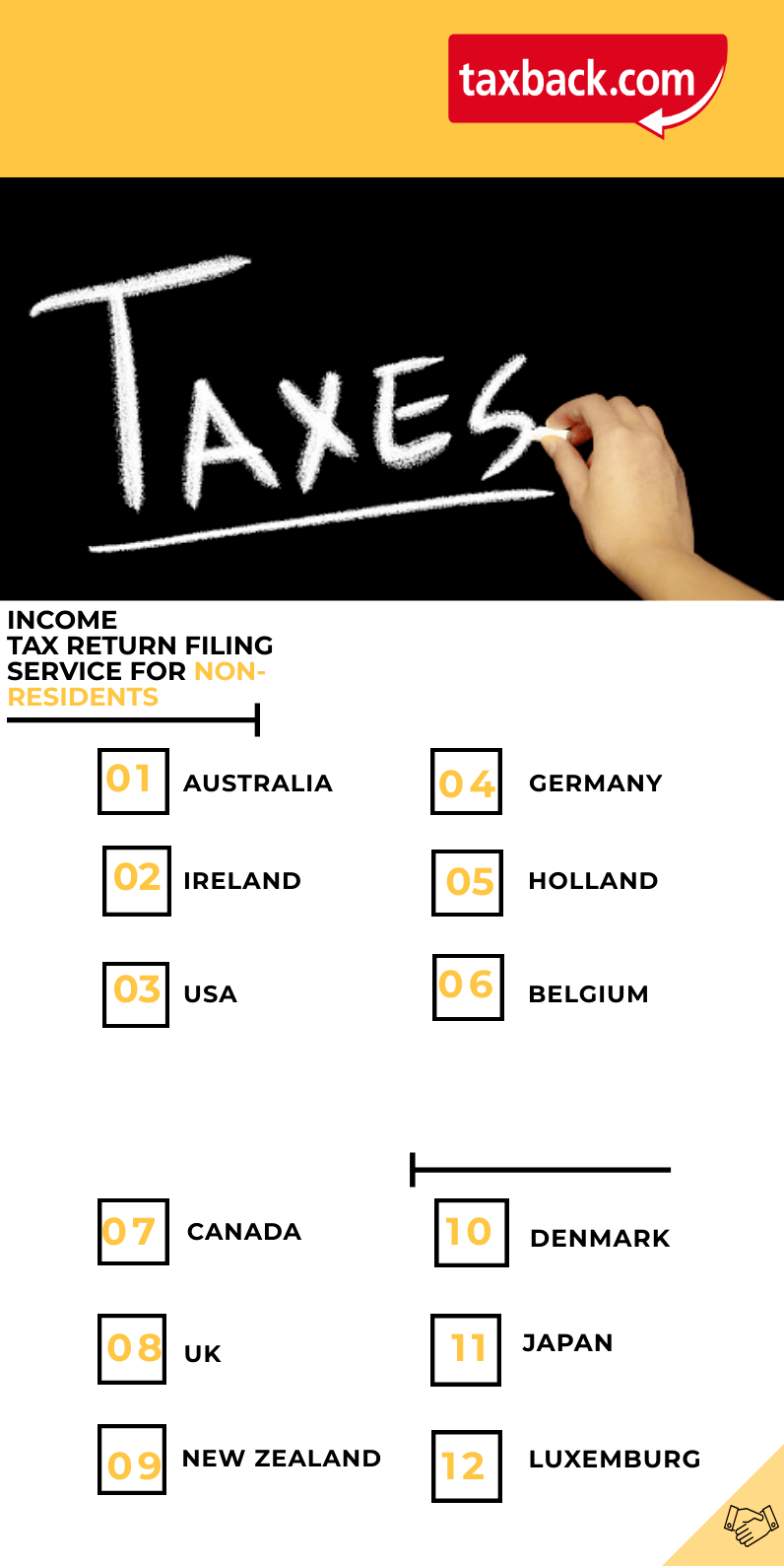

What Happens If You HavenT Filed Taxes In 3 Years Canada. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more. Havent filed taxes in years canada.

Most Canadian income tax and benefit returns must be filed no later than April 30 2018. Havent Filed Taxes in 10 Years If You Are Due a Refund. Late filing charges and penalties begin as soon as you miss the tax deadline typically April 30 each.

As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late. What happens if you havent filed taxes in 10 years in Canada. Were just about ready to send in our application and Im starting to get worried.

For more recent returns you can file using government. Havent Filed Tax Returns in. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure.

All canadians have to file their tax returns every year. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

The CRA lets you file taxes as far back as 10 years but youll need to submit paper returns for anything prior to 2017. Start with the 2018 one and then go back to 2009 and work your way back. And unless the Canada Revenue Agency CRA.

Get all your T-slips and what ever. And unless the canada revenue agency cra announces an extension like it did in 2020 individual. This is because the CRA charges penalties for filing and paying taxes late.

If you go to genutax httpsgenutaxca you can file previous years tax returns. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure. According to Section 238 of the Income Tax Act failing to file your tax return can result in a fine of 1000 25000 and up to one year in prison.

You dont know where to start and youre. If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due date. March 27 2018 Ottawa Canada Revenue Agency This year as a result of a number of new services that the Canada Revenue Agency CRA has put in place it has never been.

The CRA may not have contacted you yet but it doesnt mean it will never. Have you been contacted by or acted upon Canada. Havent Filed Tax Returns in Years Voluntary Disclosure Program VDP You want to file your income taxes but you havent done so for years.

It depends on your situation.

What Really Happens If You Don T File Your Taxes

Declaring Foreign Income In Canada

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Haven T Done My Taxes In More Then A Half Of Decade R Personalfinancecanada

My Dad Claimed Me As A Dependent On His 2018 Return I Haven T Filed My 2019 Return Can I Still Claim 1 200 Answers To Your Stimulus Check Questions Part 2 Marketwatch

How To File Overdue Taxes Moneysense

What To Do If You Haven T Filed Taxes In Years Money We Have

They Re Looking At Where You Live If You Re Wealthy And Haven T Filed Your Taxes The Irs Could Soon Be Ringing Your Doorbell Marketwatch

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

What Happens If I File My Taxes Late Penalties And Interest As Usa

Filing Your Taxes Late Turbotax Tax Tips Videos

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Who Goes To Prison For Tax Evasion H R Block

How To File Us Tax Returns In Canada Ultimate Guide

Liberty Tax Canada Haven T Filed Your Taxes In A While We Can Source Slips So You Can Be Caught Up And Receive The Benefits You Are Missing Out On Catching Your

Anthony Bourdain Owed 10 Years Of Taxes

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

2 Million Canadians Who Haven T Yet Filed Taxes Could Face Benefits Interruption Cra Warns National Globalnews Ca